Saturday, July 31, 2010

Of Money (4)

Of Money (4)

Everyone thinks the Federal Reserve printed too much money. I'm saying that's not what happened. Our central bankers restricted the money to fight inflation. They restricted it almost continuously. It was Congress that messed up monetary policy by continuously encouraging the use of credit.

Credit is just as good as money, except it costs a little more to use... And using credit creates debt. Other than that, credit works just like money, and you can go a long time using credit instead of money, and accumulating debt, and embedding extra cost all through the economy. And that's exactly what we did.

And we used credit for money, and it increased demand. And the Federal Reserve saw inflation, and they restricted money further. And Congress saw tight money, and they encouraged additional uses of credit.

And we used credit for money, and it increased costs. And Congress saw weakness in the economy, and encouraged additional uses of credit.

And I said: We have monetary imbalance.

Friday, July 30, 2010

Of Money (3)

Of Money (3)

In Of Money (2) I said what's important is M1 money, and my graphs show that M1 has had a declining influence on inflation since the late 1950s.

YOU: So why use M1 money, if it has a declining influence on inflation?

ME: Maybe inflation isn't the problem. Maybe inflation is a result of the problem. Maybe M1's declining influence is the problem, or part of the problem, or an indication of the problem that causes inflation.

The reason we never solved the inflation problem is that inflation isn't the problem. Inflation is a result. We never solved the inflation problem because we never paid attention to the declining influence of M1 money. Economists and policymakers never saw that decline as a problem. They only tried to make allowances for it, encouraging the use of credit and encouraging the growth of savings, the source of credit.

What matters is the balance between the two components of M2 money: the balance between money in savings, and M1 money in circulation. When I talk of "monetary imbalance" it is the imbalance between these two components of M2 to which I refer.

The declining influence of M1 money is a direct result of the declining size of M1 as a portion of M2 money. A direct result of the decline of M1 relative to money in savings. A direct result of the increase of money in savings relative to M1 money. And a direct result of the growth of credit-use built upon those savings.

When other people talk about the cause of inflation, they talk about printing money. They talk about the quantity of money. But they never look at the components of money. They never look at the imbalance between the components. And they never look at the inflationary consequences of credit use.

Thursday, July 29, 2010

Of Money (2.1)

Of Money (2.1)

Here's a screenshot of "popular" data you can get from the Federal Reserve Bank of St. Louis. It's part of their excellent excellent FRED stuff.

At the bottom of that list you can find M2 money. That's a popular number, M2.

Where's M1? Nobody cares about M1. When you start to see M1 on the list of popular data, you'll know Arthurian economics is having an effect.

Wednesday, July 28, 2010

Of Money (2)

Of Money (2)

When I look at inflation I use M1 money, the "funds that are readily accessible for spending." My graphs show that M1 has had a reduced influence on inflation since the late 1950s or early '60s.

Hardly anybody uses M1. Most economists use M2 or new measures. Milton Friedman in his book Money Mischief used M2 for his graph of U.S. inflation. M2 includes the same spending-money that I use, plus the money in savings. So of course M2 is a much bigger number than the spending-money number.

But we don't spend money that is in savings. It does not increase effective demand. It does not facilitate transactions. There is no direct relation between prices and money in savings. Friedman's graph used bad arithmetic to give the appearance of a direct relation that does not exist in fact.

We don't spend the money in savings. And if we do spend it, it comes out of savings and goes into circulation. So then it counts as spending-money. If we spend it, it counts as M1. If that money affected demand or prices, it would show up in the spending-money (M1) numbers. It does not show up in M1.

Maybe economists would say there is a "wealth effect." In other words, because we have more money in savings, we are more willing to borrow and spend. Well, that could be true. But if it is true, it still isn't the money in savings that affects prices. It is the money that we borrow and spend -- credit-money -- that facilitates transactions and influences prices.

Money in savings is not the same as money in circulation. Only circulating money is spent. The money in savings is used to make loans, and create debt, and to create the credit-money that we spend, which also contributes to inflation. But economists don't seem to worry about credit-use when they worry about inflation. They always want us to use more credit. That's how we got into this mess.

Tuesday, July 27, 2010

Of Money

Of Money

Back in 1976 I had some "Don't Waste Your Vote" flyers printed up. This was when Jimmy Carter was running against Gerald Ford for President. In the flyer I said "Neither [candidate] represents or supports any policy or takes a stand on a single issue, except those each thinks essential to win the election."

That could be more true today than it was in 1976.

In the flyer I also said "No one has any money, but there is just as much money in circulation as ever there was." And that was dead wrong. There is not just as much money in circulation now as ever.

The economy is bigger now. We produce more and there are more of us now than in 1976, and there must be more money to compensate for these factors. But one can imagine the quantity of money growing exactly in proportion to the economy. And we can think of that as "just as much" money. And that is the right way to think of things in a growing economy.

By that measure, there is not just as much money now as there ever was.

Before the recent crisis, we had decades of inflation. And everybody knows printing money causes inflation. So nobody has to look at the numbers to know there is more money in circulation than ever there was before.

But when you look at the numbers, it turns out there is not more money in circulation than ever. There is less.

What numbers? The amount of spending-money we have in this country for one, and the total value of the output we buy each year at the prices we actually pay. Those are my numbers. Economists use different numbers. But then, economists have failed to solve the problem. They didn't even see the crisis coming, except 16 of them.

The amount of spending-money we have is the standard measure called M1 money. M1, according the the St. Louis Fed, "includes funds that are readily accessible for spending." M1 is spending-money, or money in circulation. It is the money we use to buy things, and the money we accept as payment. M1.

My other number -- the total value of output -- is output at the prices we actually pay, or nominal GDP, or just GDP.

Those are my numbers. My numbers show that spending-money has declined from 35 cents per dollar's worth of output (in 1951) to 25 cents (in 1962) to 15 cents (in 1979) to 12 cents (1999) to 10 cents in 2006-07. That's why nobody has money these days. That's why business is not so good. And that's why we use so much credit.

Monday, July 26, 2010

Two Thought Experiments

Two Thought Experiments

1: Suppose we take a good long 2-by-4 and nail it to the side of a barn, so that it sits at eye-level and sticks out 8 or 10 feet past the corner of the barn. So maybe your kids could do chin-ups on it.

Now take a piece of rope and tie it to a cinder block and hang it from the free end of the 2-by-4. Get another cinder block and do the same thing. Get some more -- do they still call them cinder blocks? -- and keep hangin'em the same way off the end of the 2-by-4.

After a while the 2-by-4 starts to bend a little bit. Don't worry about that. Just keep hangin' blocks off the end of it until the 2-by-4 snaps. Oh -- be sure you stay out of the way, so you don't get hurt. And the kids, too.

Okay, got the picture? I have a question for ya: Could ya see it comin'? Could you see trouble coming? Did you know that the 2-by-4 was going to break at some point? I think so. I think you knew. Maybe you didn't know how many cinder blocks the 2-by-4 would hold. But for sure you knew one of them would be the one that broke the camel's back, so to speak.

2: Okay, now another exercise: Take the economy and nail it to the side of the barn so it sticks out just like the 2-by-4, and hang a trillion dollars of debt off the end of it. Hang another trillion dollars of debt off the end of it, and another and another and another. Keep going... At some point, do you think the economy will snap like a 2-by-4? I bet it will. I bet you think it will, too.

Thing is, nobody knows how much debt the economy can support before it suddenly snaps. So the only way to find out is the hard way.

To me it's not so difficult. At some point the economy starts to bend, just like the 2-by-4 did. That would be a good time to stop adding more weight. Maybe, take some weight off. Simple enough, isn't it?

For the record, our economy started bending under the weight of debt in 1973.

//

Paul Krugman here links to a Financial Times article by Ken Rogoff, and proceeds to "differ" with Rogoff.

Comment number 11 following that post caught my eye:

Clearly, at *some* point, even in the U.S., debt levels would matter. Ken's main point in the FT is that debt crises happen in a non-linear way: everything is fine, as it was for the markets in 2006 and the first half of 2007, until suddenly, it wasn't anymore. Seems wiser, to me, to be conservative about where that level might be, especially since we can only make educated guesses about it.

I don't know whether stresses affect the 2-by-4 in a "non-linear" way. But I know the stresses are obvious for a good long time before the 2-by-4 snaps. So I don't think it's right to say "everything is fine... until suddenly, it wasn't anymore." Not for the 2-by-4, and not for the economy.

I would agree absolutely with the last sentence of Comment Eleven's excerpt: Seems wiser, to me, to be conservative about where that level might be, especially since we can only make educated guesses about it. At some point the economy starts to show stress. That's the sign that we must stop accumulating debt.

Unfortunately, one does not simply stop accumulating debt. One either struggles with balancing the budget for decades after the stresses appear, as we still struggle; or one discovers a better analysis of the problem, and develops solutions that work.

Sunday, July 25, 2010

Math Problems

Math Problems

Links lead to links, and I end up reading things I have no interest in. That happened just now. As I quit reading, the words struck me: Works by Romer and Rosenthal (1979) and McKelvey (1976) showed that,

when political issues are considered multidimensional rather than single dimensional, an agenda setter could start at any point in the issue space and, by strategically selecting issues, end up at any other point in the issue space, so that there is no unique and stable majority rule outcome.

By strategically selecting issues, one can argue to any outcome.

Yes. It is like solving a math problem: There may be dozens of ways to approach the problem. But there is only one right answer. And if your approach doesn't give the right answer, you used the wrong approach.

Does it matter? It's only the economy. So what if we get the wrong answer. At least we won the election. Right?

Saturday, July 24, 2010

The 60-Year-Old Bubble

The 60-Year-Old Bubble

At Business Insider, Gregory White and Kamelia Angelova write:

Worries are expanding over whether or not the global economic recovery is going to be able to persist with banks not lending to consumers. That lack of lending is a result of individuals, corporations, and banks preferring to pay off old debts rather than take on new debt or provide new loans.

That's just one more way to say the economy will not recover until we get rid of some of this existing debt. So again I say, let's not have the Federal Reserve print money and use it to buy up debt. Have them use that money to pay off debt.

The Business Insider article also quotes Christopher Laird:

The point of emphasizing it's from the end of WW2 is that we are not talking merely about a banking crisis, or whatever. We are talking about the deleveraging of the greatest economic/finance bubble in history.

Since the end of World War II, we have been restricting the quantity of money in circulation and encouraging the use of credit. These policies are directly responsible for increasing leverage and for creating "the greatest economic/finance bubble in history."

The policies have to change.

Friday, July 23, 2010

Self-Slotting Economists

Self-Slotting Economists

Recently I quoted Keen:

And responded:

It's worse than weird. It's pointless.

I know with politics, we have two parties. I like some things each party says, and reject other things. But if you watch TV you know that you have to be one or the other, and that no one in his right mind would be thinking for himself.

Same with economics. For me, economics is the effort to understand what happens in the world that I see. For Keynes, for Adam Smith, for Bastiat and Say I am certain it was no different -- I am certain the effort was no different.

But I am also certain that the economy itself was quite different. That's why the observations change. What was true on the upswing was no longer true at the peak; and what was true at the peak is no longer true in the decline. The economy changes. That's what business cycles are: Changes. So, observations that were correct once will not be correct forever.

It is worse than pointless to pick a side, or pick a slot, or pick an economic theory and say this is the universal answer. Because the economy is changing all the time.

A majority of the 16 individuals identified in Bezemer (2009) and (Fullbrook (2010)) as having anticipated the Global Financial Crisis followed non-mainstream approaches to economics, with most of them identifying as Post-Keynesian ... or Austrian....

And responded:

The trouble with economists is that they seem to insist -- even the sixteen wisemen among them -- insist on categorizing themselves as "post-Keynesian" or "Austrian" or "mainstream" or in some other group. Everybody wants to be in a slot. That's weird.

It's worse than weird. It's pointless.

I know with politics, we have two parties. I like some things each party says, and reject other things. But if you watch TV you know that you have to be one or the other, and that no one in his right mind would be thinking for himself.

Same with economics. For me, economics is the effort to understand what happens in the world that I see. For Keynes, for Adam Smith, for Bastiat and Say I am certain it was no different -- I am certain the effort was no different.

But I am also certain that the economy itself was quite different. That's why the observations change. What was true on the upswing was no longer true at the peak; and what was true at the peak is no longer true in the decline. The economy changes. That's what business cycles are: Changes. So, observations that were correct once will not be correct forever.

It is worse than pointless to pick a side, or pick a slot, or pick an economic theory and say this is the universal answer. Because the economy is changing all the time.

Labels:

Cycle of Civilization

Thursday, July 22, 2010

"Civilizations die from suicide..."

"Civilizations die from suicide..."

Wikipedia:

For Toynbee, a civilization might or might not continue to thrive, depending on the challenges it faced and its responses to them.

When a civilization responds to challenges, it grows. Civilizations declined when their leaders stopped responding creatively, and the civilizations then sank owing to nationalism, militarism, and the tyranny of a despotic minority. Toynbee argued that "Civilizations die from suicide, not by murder."

The economic solution of the past 30 years -- the continuous concentration of income and continuous increase of debt -- was never a sustainable solution. The growth of debt and the concentration of income are self-destructive: Neither can last indefinitely. Toynbee would not have accepted these economic policies as a "creative" response.

Labels:

Cycle of Civilization

Professor Commons

Professor Commons

HARI SELDON-- ...born in the 11,988th year of the Galactic Era; died 12,069.

Nations last two hundred years. Civilizations last two thousand. Why is that? Why can't we keep it together for twelve thousand years?

Read these two pages, and you'll know as much as I do about Professor Commons. Or read the abridged version below, from Essays in Persuasion:

Professor Commons... distinguishes three epochs, three economic orders, upon the third of which we are entering.

The first is the Era of Scarcity... In such a period, 'there is the minimum of individual liberty and the maximum of communistic, feudalistic, or governmental control...'" This was, with brief intervals in exceptional cases, the normal economic state of the world up to (say) the fifteenth or sixteenth century.

Next comes the Era of Abundance. 'In a period of extreme abundance there is the maximum of individual liberty...'" During the seventeenth and eighteenth centuries we fought our way out of the bondage of Scarcity into the free air of Abundance, and in the nineteenth century this epoch culminated gloriously in the victories of laissez-faire and historic Liberalism. It is not surprising or discreditable that the veterans of the party cast backward glances on that easier age.

But we are now entering on a third era, which Professor Commons calls the period of Stabilisation... In this period, he says, 'there is a diminution of individual liberty....

Scarcity... Abundance... and Stabilization. If there are business cycles -- and cycles within cycles -- then there is a Cycle of Civilization. The Dark Age is a Great Depression. The Era of Scarcity is the long, slow, painful recovery. The Era of Abundance is the boom, the peak of the cycle. And the Era of Stabilization is the Professor's optimistic misnomer for crisis-and-decline.

If we're good, if we choose wisely, if we don't proceed blindly, then there is a chance we can ride that economic wave like a surfer. But if we proceed blindly, it's over.

Early in what became the Great Depression, John Maynard Keynes was asked if anything similar had ever happened. "Yes," he replied, "it was called the Dark Ages, and it lasted 400 years."

If we can learn to surf the economic wave, we can have our Era of Stabilization. We can get to those five-digit years.

Labels:

Cycle of Civilization,

Five-Digit Years

Wednesday, July 21, 2010

Savings That Once Went

Savings That Once Went

A FOLLOW-UP TO THE PREVIOUS POST

Are savings fully and promptly converted into investment spending? It depends upon economic conditions. The time of Bastiat and Say was the time Keynes identified as "the greatest age of the inducement to investment". That age, some 150 years in length, was the economic peak of the cycle of civilization.

Bastiat and Say reported what they saw in the world of their day. They saw full, prompt, and automatic conversion of savings into investment spending. But what was true in their day is true no longer. Nor does it become true simply because today's self-slotting economists endlessly repeat their words.

We are past the peak. We are on the downhill slope of the cycle of civilization. We can arrest the decline if we face it. But if we choose to deny the possibility -- if we refuse to confront it -- we are clearing the way for the Dark Age to follow our civilization.

Are savings fully and promptly converted into investment spending? It depends upon economic conditions. The time of Bastiat and Say was the time Keynes identified as "the greatest age of the inducement to investment". That age, some 150 years in length, was the economic peak of the cycle of civilization.

Bastiat and Say reported what they saw in the world of their day. They saw full, prompt, and automatic conversion of savings into investment spending. But what was true in their day is true no longer. Nor does it become true simply because today's self-slotting economists endlessly repeat their words.

We are past the peak. We are on the downhill slope of the cycle of civilization. We can arrest the decline if we face it. But if we choose to deny the possibility -- if we refuse to confront it -- we are clearing the way for the Dark Age to follow our civilization.

Labels:

Cycle of Civilization

Tuesday, July 20, 2010

Savings That Would Otherwise Go

Savings That Would Otherwise Go

Some time back, Paul Krugman wrote of a Dark Age of Macroeconomics. Specifically:

First Eugene Fama, now John Cochrane, have made the claim that debt-financed government spending necessarily crowds out an equal amount of private spending, even if the economy is depressed...

Krugman quotes Fama:

The problem is simple: bailouts and stimulus plans are funded by issuing more government debt. (The money must come from somewhere!) The added debt absorbs savings that would otherwise go to private investment...

Fama doesn't say the savings might otherwise go to private investment. He says those savings unquestionably would be put to that use, if only the government didn't borrow the money. But when the economy is depressed and investment spending is falling, confidence like Eugene Fama's is unwarranted.

And Krugman quotes Cochrane:

First, if money is not going to be printed, it has to come from somewhere. If the government borrows a dollar from you, that is a dollar that you do not spend, or that you do not lend to a company to spend on new investment. Every dollar of increased government spending must correspond to one less dollar of private spending...

Cochrane, like Fama, expresses full confidence that every available dollar of savings will be used to fund new investment, if only the government doesn't get to it first. His confidence, like Fama's, is unwarranted. But Cochrane also commits word-crimes.

Cochrane uses sentence construction -- word order -- as a substitute for chronological order: If the government borrows a dollar from you, that is a dollar that you do not spend... Cochrane makes it sound as though government has dibs on my paycheck.

Only the withholding, Big-C, only the withholding. The rest of it comes to me. And the government can not touch that part of my income before I make my spending and saving decisions. It is a cheap trick, Cochrane's use of word-order as a substitute for chronological order, and it deserves nothing but scorn.

Krugman writes: "There’s no ambiguity in either case: both Fama and Cochrane are asserting that desired savings are automatically converted into investment spending, and that any government borrowing must come at the expense of investment — period."

Krugman is right to doubt the "automatic" conversion of savings into investment spending. But for the sake of accuracy, perhaps the phrase "fully converted" would be more apt than Krugman's "automatically converted."

Full, prompt conversion of savings into investment spending cannot be taken for granted in the slump. When people are worried and saving more, and businesses are worried and investing less, there is a mis-match between savings and investment. At such times, there is no guarantee of full, prompt, automatic conversion of savings into investment spending.

At such times, it is not wise to leave things to chance. That is precisely what Keynes pointed out so many years ago:

Those who think in this way... are fallaciously supposing that there is a nexus which unites decisions to abstain from present consumption with decisions to provide for future consumption....

Are savings fully and promptly converted into investment spending? The answer depends upon economic conditions. When the economy is healthy and growing, yes: We can trust that all or nearly all savings will be recycled back into the spending stream as investment or as some other use of credit.

But when the economy is in a slump? No. Investment spending is being reduced at just the time when people are saving more.

Monday, July 19, 2010

Sunday, July 18, 2010

What I Said

What I Said

Back in 1977 I wrote a little book on the economy called Small Change. In it I wrote:

For an economy, good times mean growth: a better standard of living; more jobs, more productivity, more money to spend. But often, one side effect of the good times is rising prices -- inflation.

According to the theory, after the good times have lasted a while, inflation and other factors may begin to weaken the economy's growth. Eventually, conditions get bad enough that the economy begins to shrink. The result is a recession....

Things eventually get so bad that they 'can't get any worse,' and then the economy begins to grow again. Thus the pattern the economy weaves is a cycle of growth and recession.

Enough.

So in 1977 I thought that time, inflation, and other were the factors that cause recession. And that time and lousy conditions are the factors that restore growth.

Isn't that inadequate? I think so, now. But a lot of economics is empty like that.

Saturday, July 17, 2010

Coping Around the Problem

Coping Around the Problem

Bizarre: The magazine is now Readers Digest.com. Anyway, in the August 2010 issue, pages 10 and 11, we find the article Extreme Makeover: College Edition by Dawn Raffel. Subtitle:

With tuition sky-high and the job market bottoming out, one professor suggests major changes

Okay, I'm thinking, This is about the economy. What does the guy have to say?

The professor is Mark C. Taylor of Columbia University. These are the economic problems he identifies:

- the high price and low yield of a college education

- our higher education system fails to prepare people to thrive

- our higher education system is headed for a financial meltdown

- costs are only going up

- second mortgages to pay for college no longer viable

- students are going deeper into debt

- "we're training people for whom there are no jobs"

- "It's incumbent on us to find new ways of financing what we do."

Note that these are economic problems, not strictly educational problems.

These are solutions that Taylor proposes:

- require students to collaborate across majors to improve "creativity"

- schools should specialize and students should take courses at multiple schools

- "wealthier schools... have a moral obligation to share with the have-nots"

- schools should partner with corporations

- kill tenure

- emphasize teaching rather than research and writing

- "Why are all courses the same length?"

- "Why are they worth the same credits?"

- "Why is college four years?"

As Dawn Raffel writes, Taylor wants to "question everything." Taylor's proposals strike at the foundation of the education system because "Schools are built on an old model" that isn't working in this economy.

Mark Taylor surveys the damage and provides a statement of economic problems. The problems he identifies are generally the same in schools and homes and businesses and governments, across the country and around the world: problems of cost, and of jobs, and of debt, and of "financial meltdown." Economic problems.

But Taylor's solutions are not solutions to economic problems. Rather, they are ideas that would undermine the standard educational environment. Given that our higher education system fails to prepare people to thrive, in an economy where no one is thriving, one must ask: Is the problem in the education system, or in the economy?

Taylor's ideas are only a way for colleges to cope with their economic problems. They are not a way to solve those problems, for colleges or for anyone else. If the problems remain unsolved, coping is necessary. But Taylor has no solutions.

Labels:

Coping

You've Heard This Before

You've Heard This Before

I'm looking into the Federal Funds rate for some other post...

Google finds me a page from the EconModel site...

I like it immediately, the site I mean...

Judging a book by a page at random. Anyway...

The Fed Funds Rate page says, among other things:

A decrease in the federal funds interest rate stimulates economic growth, but an excessively high level of economic activity can cause inflation pressures to build to a point that ultimately undermines the sustainability of an economic expansion.

"An excessively high level of economic activity can cause inflation."

It can, sure. But something else must have caused the inflation we've been having since about 1973. Because we have not had anything like an excessively high level of economic activity since then.

[See also]

Friday, July 16, 2010

By Feel Alone

By Feel Alone

Whether you agree with Paul Krugman or not, his 9 July post is a serious statement:

It’s now obvious that the stimulus was much too small; yet there’s virtually no chance of getting additional measures out of Congress.

We’ll never know whether the administration could have passed a bigger plan; we do know that it didn’t try.

Those concerns were what had me fairly frantic in early 2009...

And here we are. From a strictly economic point of view, we could still fix this... But politically, we’re stuck...

I’d like to say something uplifting here; but right now I’m feeling pretty bleak.

At the heart of that bleak setting, these words (see also here) are particularly disturbing:

Even before the severity of the financial crisis was fully apparent, the recent history of recessions suggested that the jobs picture would continue to worsen long after the recession was technically over. And by the winter of 2008-2009, it was obvious that this was the Big One — which, if the aftermath of previous major crises was any guide, would be followed by multiple years of high unemployment.

This bit of it: The recent history of recessions suggests...

And this bit: If the aftermath of previous major crises is any guide...

Do these bits of it disturb anybody but me?

Maybe Krugman is dumbing things down for his readers. But I don't think so. He's sharp, he writes well, and he can explain things simply without dumbing them down. I think he is giving a simple but accurate explanation of a problem that had him "frantic." So if he's not dumbing things down, then what is he doing?

I wrote a little something a while back, on programming in the languages of AutoCAD. (Maybe I'll put it on line some day.) At one point I described learning to program as similar to finding your way through a cave in the dark, by feel alone.

That's what Krugman is doing. He doesn't know why the jobs picture continues to worsen long after the recession is over. He only knows that the recent history of recessions suggests it is likely to happen again. He does not know why major crises are followed by multiple years of high unemployment. He only knows that it often happens. Krugman is doing economics by feel alone.

Thursday, July 15, 2010

The Final Onion

The Final Onion

According to Keen, one of the 16 people identified as having anticipated the global financial meltdown is Kurt Richelbacher.

Kurt R... Despite my bad memory, the name was immediately familiar. Rummaging through my bookshelf, I found the old magazine. An advertisement really, a magazine-size advertisement from a company called Investment Rarities Incorporated. (I don't mean to advertise for them here, but I respect information sources.)

On page 5 is a Q&A with Dr. Kurt Richebacher. No "L" in the name; but it's gotta be the same guy. Richebacher's first answer is the reason I saved that magazine:

Q: Give us the cause of the profits problem.

A: Corporate cost cutting, for one. The widespread measures that individual firms take to improve their own profits have, in the aggregate, the opposite effect on the profits of other firms. Business spending is the key source of business revenues, not consumer spending. A retrenchment in business spending cuts business revenues. Higher profits and higher prosperity cannot possibly come out of general cost cutting.

A really good statement. The first sentence of the answer gives us Dr. Richebacher's sense of priorities. The last sentence is almost Keynesian in its clarity of thought. The second is a nice expression of the paradox of deleveraging or the paradox of thrift. And the third sentence is the topic here today.

Business spending (not consumer spending) is the key source of business revenues.

My posts of 23 and 24 June refer to total corporate deductions in the amount of $25.5 trillion (for 2006) and $26.97 trillion (for 2007). But the U.S. GDP in 2006 was $13.4 trillion, and in 2007 under $14.1 trillion. Corporate tax deductions were nearly twice the nation's GDP each year. And those numbers are typical.

Maybe people know this, I don't know. I've known it for a long time, and I still find it surprising. And by the way, that's just corporate tax deductions. Doesn't include tax deductions of non-corporate businesses.

How can this be?

Ever peel an onion? There's a big difference between a solid, baseball-size onion and the first thin dry layer that comes off in your hand. Only the thin dry layer is taxed. The rest is all tax deductions.

Imagine an economy where everybody manufactures artificial onions. There are many different companies involved; each company adds a new outer layer and sells enhanced onions.

The "value added" by each company is the new outer layer. But no company sells only the outer layer. Every company buys onions, enhances them, and sells enhanced onions.

The final onion, with all the layers on it, is the total value added. All the work that everybody did is in there. The final onion is GDP.

But it doesn't get sold only once. Somebody makes the juicy center, and sells it. Somebody adds the first layer, and sells it. Somebody adds the next layer, and sells it. Somebody adds the next layer...

If there are a dozen layers to the onion, the thing gets sold a dozen times. If each stage of production adds a dollar to the price of it, the final sale price is $12. But the total spending is 12+11+10+9+8+7+6+5+4+3+2+1.

The total spending in our economy is much the same as the total spending on that onion. The final sale price or the "final spending" is what counts as GDP in our economy. But beneath the outer layer there are many preliminary or intermediate transactions. Each of those adds a little to the final price, but much to total spending.

When you look at the "total" spending involved in all of those transactions, it is a big number, much bigger than the "final" spending number. Most of those transactions are business-to-business transactions, the ones that add layers to the onion. And most of those payments are tax deductible. And that is how total corporate tax deductions got to be so much bigger than GDP.

But when it comes time to cut business spending, business-to-business transactions take a big hit. As Richebacher says, "A retrenchment in business spending cuts business revenues." Corporate cost cutting cuts corporate income, pinching the thin dry layer of profit.

It is the downtrend that spreads disaster. The solution is to keep the economy growing. Richebacker says it best: "Higher profits and higher prosperity cannot possibly come out of general cost cutting."

Wednesday, July 14, 2010

Up, Up and Away

Up, Up and Away

This is the Monetary Imbalance graph from yesterday's post. It uses numbers from Series X 410-419 of the Historical Statistics.

The blue trend-line goes up from 1915 until the Great Depression. Then it falls until the middle of World War II. Then it goes up again. By 1970 it is higher than when the Great Depression started. By 1970 we could have known trouble was on the way.

Below is the Monetary Imbalance graph, long-term. This graph uses the same Series X numbers for the blue 1915-1970 trends, and FRED numbers for the more recent red trendline, 1959-2010. I have made this graph an odd size so that the blue 1915-1970 trend-line looks like the graph above.

Again for comparison:

The blue trend-line goes up from 1915 until the Great Depression. Then it falls until the middle of World War II. Then it goes up again. By 1970 it is higher than when the Great Depression started. By 1970 we could have known trouble was on the way.

Below is the Monetary Imbalance graph, long-term. This graph uses the same Series X numbers for the blue 1915-1970 trends, and FRED numbers for the more recent red trendline, 1959-2010. I have made this graph an odd size so that the blue 1915-1970 trend-line looks like the graph above.

Again for comparison:

Tuesday, July 13, 2010

Zig, Zag, Zig

Zig, Zag, Zig

This is a graph from Paul Krugman's Inequality and Crises PDF. The trend-line rises to a sharp peak somewhere around 1933, then falls until about 1945, then begins another long rise.

This is my graph of (M2-M1)/M1, or Money in Savings relative to Money in Circulation. This is the graph that shows Monetary Imbalance. It rises to a peak around 1930, falls until 1945, then begins another rise.

This is my graph of Debt per Dollar, or DPD. This is the graph that shows excessive debt. It rises to a peak in 1933, falls to a low in 1947, then begins another long rise.

Total Debt (relative to the quantity of M1 money) follows a pattern very similar to Total Savings (relative to the quantity of M1 money). Both follow a pattern very similar to Krugman's Finance as a Share of GDP.

Savings are the raw material of Finance, and Debt is its product. The three graphs move together because of this relationship.

Should we so desire, U.S. monetary policy can control both the level of Debt and the preponderance of Finance, simply by controlling the relation between Savings and M1 money.

If you think it wise to get debt under control... If you think it a good idea to get Finance under control... Then you must reduce and stabilize the ratio of Savings to Circulating money.

Nothing else will solve our economic problem.

This is my graph of (M2-M1)/M1, or Money in Savings relative to Money in Circulation. This is the graph that shows Monetary Imbalance. It rises to a peak around 1930, falls until 1945, then begins another rise.

This is my graph of Debt per Dollar, or DPD. This is the graph that shows excessive debt. It rises to a peak in 1933, falls to a low in 1947, then begins another long rise.

Total Debt (relative to the quantity of M1 money) follows a pattern very similar to Total Savings (relative to the quantity of M1 money). Both follow a pattern very similar to Krugman's Finance as a Share of GDP.

Savings are the raw material of Finance, and Debt is its product. The three graphs move together because of this relationship.

Should we so desire, U.S. monetary policy can control both the level of Debt and the preponderance of Finance, simply by controlling the relation between Savings and M1 money.

If you think it wise to get debt under control... If you think it a good idea to get Finance under control... Then you must reduce and stabilize the ratio of Savings to Circulating money.

Nothing else will solve our economic problem.

Monday, July 12, 2010

Ditto

Ditto

Back at the beginning of '09, Paul Krugman was iterating about a Dark Age in economic thought. He happened to quote, among other things, this from John Cochrane:

Second, investment is “spending” every bit as much as consumption. Fiscal stimulus advocates want money spent on consumption, not saved. They evaluate past stimulus programs by whether people who got stimulus money spent it on consumption goods rather save it. But the economy overall does not care if you buy a car, or if you lend money to a company that buys a forklift.

I think a word or two got lost in translation. But that is one precious paragraph. PK let it slip away. Here are my notes:

1. Investment is “spending” every bit as much as consumption.

Yes, yes, yes. When somebody buys industrial equipment or puts up a factory building, that's investment. More precisely, it is investment spending. When I stick a dollar in my savings account, that's not investment. It's investment when Dean Kamen takes a loan and spends the money to build another nifty invention. It's investment when money gets spent like that.

2. Fiscal stimulus advocates want money spent on consumption, not saved. They evaluate past stimulus programs by whether people who got stimulus money spent it on consumption goods rather save it.

This is a whole other can of worms. I don't like too much to talk about what other people want. So I won't talk about what Cochrane says other people want. But Big-C distinguishes clearly between spending and saving. That's important.

3. The economy overall does not care if you buy a car, or if you lend money to a company that buys a forklift.

Excellent: The economy does not care what we want. We care. Actually, I'm surprised Cochrane says that to the economy, consumption spending (buying a car) is no different than investment spending (buying a forklift). But then I guess the economy doesn't care if it grows, or not.

Inadequate growth is not a problem for the economy. For the economy, it is a solution to Problem X. If we think inadequate growth is a problem, our task is to identify Problem X.

Ditto inflation. Ditto unemployment. Ditto ditto ditto.

Labels:

Problem X

Sunday, July 11, 2010

Words with Linda

Words with Linda

If you go here and click on the "Regular Job" video, about 24 seconds into her 61-second commercial Linda McMahon says

We're losing jobs because Washington politicians are

spending money we don't have.

Money we don't have. That's exactly what I've been saying, Linda. The Federal Reserve restricted the growth of money in order to fight inflation. But they restricted it too much. And that, Linda, is why we don't have money.

Nobody believes that, because of the inflation. Everybody thinks there must be too much money, because of the inflation. But nobody has money, Linda. Taxpayers and governments struggle over tax dollars; and business is not good.

Taxpayers know taxes are too high. Governments know revenues are insufficient. Businesses know income and profits are too low. No sector of the economy has the money, Linda. All sectors of the economy agree, or could agree that money has been excessively restricted by the Federal Reserve. But instead, we fight over taxes and spending.

You're right, Linda: Nobody has money. We all use credit. We all have debt. Nobody has money.

Little Sammy Has Two Santa Clauses

Little Sammy Has Two Santa Clauses

I don't usually just quote large chunks of other people's stuff, and I almost always have some comment about the quoted material. But the excerpt below, from the Wikipedia article Jude Wanniski, I found so interesting that I just want to present it:

The Two Santa Claus Theory

The Two Santa Claus Theory is a political theory and strategy developed by Jude Wanniski in 1976, which he promoted within the U.S. Republican Party.

The theory states that, in democratic elections, if one party appeals to voters by proposing more spending, then a competing party cannot gain broader appeal by proposing less spending. The "Santa Claus" of the theory title refers to the political party that promises spending. Instead, "Two Santa Claus Theory" recommends that the competing party must assume the role of a second Santa Claus by offering other appealing options.

This theory is a response to the belief of monetarists, and especially Milton Friedman, that the government must be starved of revenue in order to control the growth of spending (since, in the view of the monetarists, spending cannot be reduced by elected bodies as the political pressure to spend is too great).

The "Two Santa Claus Theory" does not argue against this belief, but holds that such arguments cannot be espoused in an effort to win democratic elections. In Wanniski's view, the Laffer curve and supply-side economics provide an attractive alternative rationale for revenue reduction: that the economy will grow, not merely that the government will be starved of revenue. Wanniski argued that Republicans must become the tax-cutting Santa Claus to the Democrats' spending Santa Claus.

Saturday, July 10, 2010

Two from My Budget 360

Two from My Budget 360

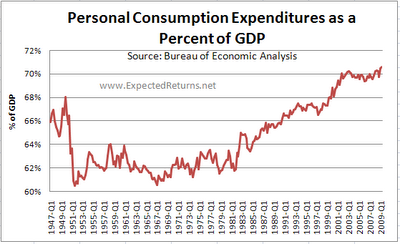

I want to point out that this graph, from the post American middle class slowly disappearing under mounds of debt...

I want to point out that if you follow along the 62% line, it looks like Personal Consumption Expenditures are stable at that level from around 1950 until 1979 or 1981 or so. And that the dramatic rise probably starts then, not around 1967 as it may appear at first. And the increase is steep when you see it starting around 1980, much steeper than it appears if you think the increase started back in '67.

And I want to point out that this graph -- Grandfather Hodges' graph, also from the My Budget 360 post -- shows pretty much the same turning point, around 1979 or 1981. The dotted red line on the graph (not my red line, this time!) has the peak a little earlier, mid-1970s or so. But that's too early, I think.

To see this trend-line work backwards. Start on the right, with the newest numbers, and picture a straight line up to the high point right around 1983. That's the kink. From there, go left to the early years of the graph with another straight line that goes down below the "8" there.

Both graphs show a turning point around 1980.

Just two more graphs that display the Keynes/ Reagan Shift.

Labels:

The K-R Shift

Oh, That's a Laugh

Oh, That's a Laugh

Looking into median family income while reviewing some Krugman posts, I find this in Wikipedia [7-2-2010] under "Household income in the United States" --

In 2007, the "real" (adjusted for inflation) median annual household income rose 1.3% to $50,233.00 according to the Census Bureau.

When you figure "real" values, they are always based on a base year: Real values are always given relative to some starting point. If you change the base year, you change the numbers that are reported as "real." So the $50,233.00 number is meaningless.

Assuming some minimal inflation, you can make "real" values sound higher by moving the base year closer to the present. You can make "real" values sound lower by moving the base year farther into the past.

It is perfectly fine to say "income rose 1.3%" from the previous year, or from some previous date. But it is utterly meaningless for Wikipedia to put a dollar amount there. The article fails to identify the base year.

Friday, July 9, 2010

Being Paul Krugman

Being Paul Krugman

Krugman of July 8, 2010:

the sensible thing [would be to] run deficits while the economy is depressed, then turn to budget-balancing once recovery is well in place

So, Krugman says: Don't worry about balancing the budget, we can balance the budget later. That's what he says on the 8th.

Krugman of 9 July 2010:

And by the winter of 2008-2009, it was obvious that this was the Big One — which, if the aftermath of previous major crises was any guide, would be followed by multiple years of high unemployment.

On the 9th, it is obvious to Krugman that we're not going to have the kind of recovery that will bring the budget into balance.

Krugman does not have the answer.

Sit Down Quickly

Sit Down Quickly

Here is logic that I dispute:

- Fact: Taxes are too high.

- Fact: Government collects all that tax revenue, and still has huge deficits.

- Conclusion: Government spending must be excessive.

I don't dispute the facts, just the conclusion. The conclusion is based on the view that excessive spending creates debt. But debt is not created by spending. Debt is created by the use of credit.

The Prodigal Son went out and spent his whole inheritance, and returned home to Daddy, broke. That was excessive spending.

Nothing in that story says he returned home in debt. The Prodigal Son is an example of excessive spending, apart from debt and deficit and the use of credit.

Oh I just noticed this: The very next story after the Prodigal Son is about the Steward who cut the debts that people owed to his boss. Now that is a story about the use of credit. And, notably, the boss was happy with the steward's work. (Perhaps because business picked up as a result.) Take thy bill, and sit down quickly, and write fifty. That's the solution to our problems, right there: Cut the debt, quickly. But I wander.

The Prodigal Son is a story about excessive spending, where the use of credit is not involved. On the other hand, the person who can barely make ends meet, the person who doesn't have the money to pay for gasoline but must put it on a credit-card in order to get to work -- this is a story about the use of credit, where excessive spending is not involved.

Excessive spending is one thing; the use of credit is another. Sometimes, perhaps often, the two are combined in a single act. But that is not always the case.

The whole world thinks we have to balance the budget, and we have to cut spending to do it, and spending is excessive. Even the people who make up the "special interests" think that way. But not me.

I think economic policy removed money from circulation, and encouraged the use of credit in its place. The result was that we learned to use credit for money. And the consequence of that was debt. Grotesque levels of debt.

It is our policy to fight inflation by removing money from circulation. It is our policy to stimulate growth by encouraging spending and the use of credit. And it is not our policy to encourage the repayment of debt. Policy -- not excessive spending -- is the source of our economic troubles.

It is time for policymakers to sit down quickly.

Thursday, July 8, 2010

Just Pay It Off

Just Pay It Off

Krugman again. He writes:

Here's what he looks at:

PK thinks the higher inflation target is the best option, if least likely. I don't even want to talk about that option. I want to talk about the Fed buying debt.

Krugman thinks the Fed can reduce long-term interest rates -- that's PK's goal -- by buying up debt. But he doesn't think it would have a "strong" effect. And he thinks it would take trillions of dollars of buying; probably closer to ten trillion than two.

Yikes.

Krugman wants to jack up inflation. This is Scott Sumner's idea, and Sumner says it well. But Krugman doesn't say why he wants to send inflation higher. So I'm gonna guess at that.

Inflation devalues debt; it makes existing debt smaller. If by inflation you double your income in the next three years, your mortgage payment will be a lot easier to bear. I think that's Krugman's goal, or part of it: to make the debt bearable.

PK, PK, I'm shakin' my head here. If you want your plan to be popular, number one, don't be calling for more inflation. I know, I bought my old house back in 1977 and with the inflation that soon followed, in a few years my monthly mortgage payment seemed like a joke. I know. But it doesn't matter. People don't want another bout of severe inflation, Paul. I don't. It doesn't matter if it would help us. It's not a solution, Paul. It's not a solution. Inflation is not a solution.

The problem is debt, Paul. You know: The Fed might buy up some of that debt, you were saying...

Paul, what are you thinking? If the Fed buys up tons and tons of debt, eventually lenders will be in good shape again. And then they'll be ready to lend again. And they'll be willing to lend us even more money, and create even more debt. Paul, what are you thinking?

Paul, Paul, Paul: It is time to stop thinking only in terms of lenders. It is time to start thinking in terms of borrowers.

Paul, the problem is debt. I don't care who owns it. I care who owes it. If the Fed buys up all the debt, every last bit, nothing has changed for me. Nothing has changed for anybody. Only for the lenders. And then they'll be ready to lend more. To hell with that, Paul! What were you thinking?

Okay, if the Federal Reserve was gonna buy debt, they would print money and use that money to buy the stuff. And then they would have the debt, and the lenders would have the new money.

What does that do for me?

Here's what I want you to do, Paul. Stop thinking only about the lenders. Start thinking also about the borrowers. Supply and demand, remember Paul? Supply and demand. Lenders and borrowers.

Here's what I want the Fed to do, Paul. I don't want them to buy debt. I want them to make debt go away. I want them to take their trillions that they're gonna use to buy debt. And I want them to use that money to pay off debt. Pay it off. Just pay it off. Make the debt go away. That's what I want.

And I'll tell you Paul, that's the only thing that will end this problem. The only thing.

OK, there are signs that the Fed is nerving itself up to do something more to support the economy. The question is, how much are the kinds of actions likely to be on the table likely to matter?

Here's what he looks at:

- Will the Fed buy long-term government debt?

- Will the Fed buy private debt?

- Will the Fed commit to a higher inflation target?

PK thinks the higher inflation target is the best option, if least likely. I don't even want to talk about that option. I want to talk about the Fed buying debt.

Krugman thinks the Fed can reduce long-term interest rates -- that's PK's goal -- by buying up debt. But he doesn't think it would have a "strong" effect. And he thinks it would take trillions of dollars of buying; probably closer to ten trillion than two.

Yikes.

Krugman wants to jack up inflation. This is Scott Sumner's idea, and Sumner says it well. But Krugman doesn't say why he wants to send inflation higher. So I'm gonna guess at that.

Inflation devalues debt; it makes existing debt smaller. If by inflation you double your income in the next three years, your mortgage payment will be a lot easier to bear. I think that's Krugman's goal, or part of it: to make the debt bearable.

PK, PK, I'm shakin' my head here. If you want your plan to be popular, number one, don't be calling for more inflation. I know, I bought my old house back in 1977 and with the inflation that soon followed, in a few years my monthly mortgage payment seemed like a joke. I know. But it doesn't matter. People don't want another bout of severe inflation, Paul. I don't. It doesn't matter if it would help us. It's not a solution, Paul. It's not a solution. Inflation is not a solution.

The problem is debt, Paul. You know: The Fed might buy up some of that debt, you were saying...

Paul, what are you thinking? If the Fed buys up tons and tons of debt, eventually lenders will be in good shape again. And then they'll be ready to lend again. And they'll be willing to lend us even more money, and create even more debt. Paul, what are you thinking?

Paul, Paul, Paul: It is time to stop thinking only in terms of lenders. It is time to start thinking in terms of borrowers.

Paul, the problem is debt. I don't care who owns it. I care who owes it. If the Fed buys up all the debt, every last bit, nothing has changed for me. Nothing has changed for anybody. Only for the lenders. And then they'll be ready to lend more. To hell with that, Paul! What were you thinking?

Okay, if the Federal Reserve was gonna buy debt, they would print money and use that money to buy the stuff. And then they would have the debt, and the lenders would have the new money.

What does that do for me?

Here's what I want you to do, Paul. Stop thinking only about the lenders. Start thinking also about the borrowers. Supply and demand, remember Paul? Supply and demand. Lenders and borrowers.

Here's what I want the Fed to do, Paul. I don't want them to buy debt. I want them to make debt go away. I want them to take their trillions that they're gonna use to buy debt. And I want them to use that money to pay off debt. Pay it off. Just pay it off. Make the debt go away. That's what I want.

And I'll tell you Paul, that's the only thing that will end this problem. The only thing.

Gold Backing and the Fractional Reserve

Gold Backing and the Fractional Reserve

In a recent post, Sackerson writes:

There is something like 100 ounces of gold "on paper" for every ounce of gold you can hold in your hand. I now often see online comments recommending the possession of physical gold because of concerns over delivery on all those paper promises.

A hundred ounces of gold on paper for every ounce you can hold in your hand. It sounds almost like fractional-reserve banking.

Wednesday, July 7, 2010

Forever More

Forever More

My son Jerry sends me this Inequality and Crises PDF from Krugman's files -- slides for a presentation. "Sparse but interesting," Jerry says. "I don't know what 'words' were going along with the slides, but I like the graphs." My reaction, of course, is less brief.

The presentation opens with a graph from Piketty and Saez, showing the "top 1% share" of income. The graph is followed by Krugman's comments:

Pre-2008: When I would talk to lay audiences about inequality, I would mention that we were reaching levels not seen since 1929 – and that would inevitably lead to questions about whether we would soon have another Depression. No, I’d say – there really isn’t a clear reason why high inequality should lead to macroeconomic crisis.

And then ....

And then we had the Paulson crisis. Krugman never saw it coming. But that's not what bothers me. Look at Krugman's words: reaching levels on the one hand, and high inequality on the other. "High inequality" suggests stable inequality. "Reaching levels" implies change.

Here, let me re-word the thing. Krugman says income inequality is increasing. People ask if this is a problem. Krugman says high inequality is not a problem.

Krugman does not answer the question. His listeners probably never got to ask the follow-up question: What about when income inequality gets higher? But if Krugman answers, No problem, then ask: And what about when it gets higher?

I prefer a different graph, from Saez. This one I've used before. I added the red lines to show the trends that I see in the numbers.

The trend for most of the 1940s, the '50s, the '60s, and most of the '70s is flat. No change. Income inequality is what it is. End of story.

But it's a different story since the end of the 1970s. Income inequality starts increasing, and it increases relentlessly.

The midsection of the graph shows income inequality stable, and at a low level in comparison to the surrounding numbers. Karl Marx might have called it a high level of inequality. Either way, low or high, it is a stable, unchanging level.

The last 30 years of the graph show income inequality increasing: changing, and continuing to change. And that's the problem, that last bit: continuing to change. Obviously the trend of increasing inequality cannot continue forever. It cannot go beyond what Krugman might call "the upper bound." It cannot increase beyond 100%. And by the last year of the Saez graph it's already at 50%.

Income inequality does not fascinate me. I do not look to it for explanations of our economic troubles. I see income inequality more as a consequence of our economic troubles than a cause. A contributing consequence, if you prefer. But hey, try this on for size:

Suppose things were different. Suppose income inequality increased as shown, but then suddenly stopped increasing at 45% or even 48%. After that the trend would be flat again. We would have "high inequality" but there is no more "reaching" for even higher levels. Maybe then we would avoid the crisis?

If that sudden stop came as the result of policy, it would not be much different than what happened by accident. A few percentage-points less inequality, perhaps, and the crisis anyway. It is the stop that creates the crisis, not the level of inequality achieved.

Perhaps if rising inequality stopped gradually? No, I don't think that would make any difference. I think the wealthy few, like everybody else, want to turn money into "more money." I think they would not be fooled by a gradual decline in the growth of their income. I think we'd have had the crisis anyway.

I think that once the increase of inequality begins, if it lasts for any length of time, faster growth of income at the top becomes the new norm. And like anyone who gets paid, at the top they find getting a raise much easier to take than a pay cut. So once the increase of inequality begins, there may be no way to avoid a crisis when it ends.

I wonder if there are any stats on that.

Tuesday, July 6, 2010

Ignorance is Bliss

Ignorance is Bliss

re: "stoking demand" versus "boost[ing] costs"

SIDEBAR:

"Printing money causes inflation." This is a notion associated with Milton Friedman, in my mind at least. But as Friedman pointed out, printing money influences prices via its affect on spending. Spending is the process by which demand is exercised. Demand is the driving force. It is a shortcut to say printing money causes inflation. Sometimes, it is a confusing shortcut. Demand is the driving force. But there is a problem with "demand" theory as well.

Demand has been supposed to cause prices to rise, as Anna Schwartz supposes, and Milton Friedman and, well, everybody. [See sidebar.] But prices are not supposed to start rising as soon as we start growing out of recession, nor while we are still in one.

That's why "stagflation" was such a big deal, way back when. The price increases are only supposed to happen, as Anna Schwartz explains, as capacity limits are approached.

Then again, as Bill Conerly's Capacity Usage graph shows, we've been reaching capacity limits at lower and lower levels since the 1960s.

So I have to say these things:

1. The argument that inflation is "demand-pull" -- that prices are pulled upward by growing demand -- does not explain the circumstances of the greater postwar period. This is important, for it was inflation that undermined the Keynesian consensus.

2. The alternative explanation -- cost-push inflation -- is often immediately rejected. "There's no such thing," I've been told by a very confident fellow. But rejection of ideas is not the same as evaluation or understanding. Anyway, the economy changes. What was true once may be true no more. Not only madmen in authority, but also men mad at authority may be slave to some defunct economist.

3. Inflation arises much sooner than it should, sooner than the standard explanation can explain. But this does not seem to bother anyone. We've settled for "low" inflation as an adequate substitute for "no" inflation. And we ignore inflation: Politicians and the media ignore inflation, until we can no longer ignore it. These are the only reasons the standard demand-pull story seems to hold true.

4. Why do we get inflation before we reach capacity limits? Why does capacity utilization peak at progressively lower levels? These are key questions, questions that if answered might help us solve the inflation problem, and help us understand the economy a little better. But it seems we prefer to ignore such questions, for they endanger our standard explanations of the world we live in.

Monday, July 5, 2010

Bowles Talks Trash

Bowles Talks Trash

Writing blog posts is like making bread. You have to work the dough and work it, and work it some more. So today I review my posts from yesterday. And don't you know, there's something else I have to say.

Something stuck in my craw yesterday, from the Parade article. It was this remark from Erskine Bowles:

In ‘97, there wasn’t a soul who believed we could balance the budget, but we did.

Erskine's magic, then, was that after starting with nothing in 1997, the budget was balanced by 1998. But that's not magic. It's trash. It stuck in my craw yesterday, and I did nothing about it. I figured it'd work itself out. But today, just now, I was reviewing my other post from yesterday, the one with federal deficit numbers, and I just started coughing it up.

Here's a brief summary of federal deficits:

The federal deficit hit a bottom at $290 billion in 1992. From that point there was continuous improvement, deficit reduction, until we achieved a budget surplus in 1998. And for two years after that the improvement did not let up.

Let's not talk about policy here, or who gets the credit. Let's look at what Erskine Bowles said. He said that in 1997, nobody had a clue we'd be able to balance the budget. But look at the graph. Look at where we were in 1997, with that very short blue bar indicating a budget very nearly in balance already.

Look at where we were in 1992, and look at the trend from 1992 to 1997, and tell me you agree with Bowles that no one thought we'd be able to balance the budget. I don't agree with Erskine Bowles on that.

Erskine, I gotta tell ya: If you want to fix the economy, ya gotta stop makin' up stories. Ya gotta start being honest about it. That's step one.

Something stuck in my craw yesterday, from the Parade article. It was this remark from Erskine Bowles:

It’s really hard. We could end up walking away with nothing. But we are working together to come up with a commonsense solution. In ‘97, there wasn’t a soul who believed we could balance the budget, but we did.

In ‘97, there wasn’t a soul who believed we could balance the budget, but we did.

Erskine's magic, then, was that after starting with nothing in 1997, the budget was balanced by 1998. But that's not magic. It's trash. It stuck in my craw yesterday, and I did nothing about it. I figured it'd work itself out. But today, just now, I was reviewing my other post from yesterday, the one with federal deficit numbers, and I just started coughing it up.

Here's a brief summary of federal deficits:

The federal deficit hit a bottom at $290 billion in 1992. From that point there was continuous improvement, deficit reduction, until we achieved a budget surplus in 1998. And for two years after that the improvement did not let up.

Let's not talk about policy here, or who gets the credit. Let's look at what Erskine Bowles said. He said that in 1997, nobody had a clue we'd be able to balance the budget. But look at the graph. Look at where we were in 1997, with that very short blue bar indicating a budget very nearly in balance already.

Look at where we were in 1992, and look at the trend from 1992 to 1997, and tell me you agree with Bowles that no one thought we'd be able to balance the budget. I don't agree with Erskine Bowles on that.

Erskine, I gotta tell ya: If you want to fix the economy, ya gotta stop makin' up stories. Ya gotta start being honest about it. That's step one.

And Now for Something Really Weird

And Now for Something Really Weird

From Steve Keen's Debtwatch of 13 June:

A majority of the 16 individuals identified in Bezemer (2009) and (Fullbrook (2010)) as having anticipated the Global Financial Crisis followed non-mainstream approaches to economics, with most of them identifying as Post-Keynesian (Dean Baker, Wynne Godley, Michael Hudson, Steve Keen, Ann Pettifor) or Austrian (Kurt Richelbacher, Peter Schiff).

Apparently they did a study -- two studies -- and found out that 16 people "anticipated the Global Financial Crisis." Only sixteen people? That is just too bizarre.

As long as I'm pointing our weird, let me offend everyone by saying this: The trouble with economists is that they seem to insist -- even the sixteen wisemen among them -- insist on categorizing themselves as "post-Keynesian" or "Austrian" or "mainstream" or in some other group. Everybody wants to be in a slot. That's weird.

By contrast, I (not an economist) consider myself a student of the economy.

But enough with the weirdness. Keen's post is excellent. It comes as close to Arthurian economics, as close to my thinking as anything I have read. First of all, Keen is more concerned with private debt than public. Second, he seems to accept increases in public debt as the solution, or part of the solution to the crisis. Third, he pays little or no attention to M2 money, at least in this article.

The above excerpt is from the introduction of his post. The excerpt below is from his conclusion, here with my interruptions:

The core propositions shared by the Bezemer-Fullbrook group were that the superficially good economic performance during “The Great Moderation” was driven by a debt-financed speculative bubble which would necessarily burst...

The shift from Keynesian economics to Reaganomics was an attempt to fix a problem. That problem was slow growth. (The problem was that we could grow faster only by accepting more inflation. Since we (reasonably) rejected that alternative, the problem was reduced to "slow growth." But perhaps this reduction muddied the analysis from which the solution emerged.)

The cause of the problem was the decline in credit efficiency. (People say printing too much money causes its value to fall. Similarly, I say using too much credit causes its productive potential to fall: It causes credit efficiency to fall.) I refer you to my Credit Efficiency post, where I say that if growth was better in the 1980s than the 1970s, it was because the increase in debt was monstrous in the '80s.

Keen says the "superficially good economic performance" since the mid- to late-80s was "driven by a debt-financed speculative bubble." I say it was driven by the growth of debt. I say the host of Debtwatch has overstated the case.

Keynesian economics died in a morass of inefficient credit. Reaganomics attempted to solve the problem by greatly increasing the quantity of credit in use. It was a brute force technique, moderately and temporarily successful, but doomed to failure because the solution was based on an incorrect understanding of the problem.

... because the debt added to the economy’s servicing costs without increasing its capacity to finance those costs. At some stage, the growth of unproductive debt had to falter, and when it did a serious financial crisis would ensue as aggregate demand collapsed.

That is a beautiful explanation of an ugly problem. But the explanation is wrong. It suggests that if all the debt was productive debt, there would have been no problem. That's blindly optimistic. Accumulating debt would have created the crisis eventually, no matter how you label that debt.

It costs more to use credit than it does to use money. And debt is the measure of credit in use. A large burden of debt means lots of credit in use. It means the cost of credit-in-use is a large component of the costs in our economy.

Costs have consequences.

The policy rescues since that prediction came true have not addressed the fundamental cause of the crisis, which was the excessive level of private debt.

The excessive level of private debt was the fundamental cause of the crisis. Yes.

The deleveraging that the Group predicted has thus been slowed to some degree by government action, but the need for that deleveraging has not been removed.

The need for deleveraging remains. I recommend direct action: Print money and use it to pay off debt. It's a crude solution, but it solves the problem quickly.

As Figure 13 in particular emphasizes, the scale of that potential deleveraging appears certain to exceed that experienced in the Great Depression.

Yeah, I've been thinking about this. There is no reason to assume that the Second Great Depression will last 10 years just because that's how long the First Great Depression lasted. If the modern version of the "Roaring 20s" lasted two or three times as long, then painful aftermath may also last a generation, this time around.

Sunday, July 4, 2010

The Blind Leading the Blind

The Blind Leading the Blind

Parade asks Can These Men Fix the Deficit?

Short answer: No.

The plan of these men is to cut spending. "Everything has to be on the table," Alan Simpson says. "We’re looking at how we can reduce discretionary spending," Erskine Bowles says, "... and mandatory spending."

What's wrong with that? Well, it doesn't work. That's what. We've been cutting spending since LBJ. And we had a total of five years with a balanced budget.

I'm not saying we need to spend more. Not at all. But I'm also not saying we need to spend less. Because the problem is not the spending we do. The problem is the stuff we use for money. We use credit for money. That's why we have so much debt.

Debt is not created by excessive spending. Debt is created by the use of credit. We're not a poor country. We're a rich country that uses credit for money. It makes us look poor, and it is making us poor. But this problem cannot be solved with spending cuts.

Another Piece of the Puzzle

Another Piece of the Puzzle

While I was gathering numbers for yesterday's post, I ran across this graph:

It's a picture of weekly values of M1, or spending money. Money in circulation. On the right, in the middle of the fat gray bar, you can see Bernanke's trillions.

What I thought was interesting about this graph was the big bump there in the middle, rising until about 1995, then falling. A big bump in the quantity of money. The bump grabbed my attention because of its timing: 1993-4-5. There was a mini-golden age in the U.S. economy from 1995 to 2004. The good years began in 1995, just as the M1 bump was peaking.

Look at the bump from a different perspective. This graph shows annual change values for the M1 numbers:

M1 money growth zig-zags all over the chart. But the low point around 1989 and the high point around 1993 -- there, where it looks like it's giving you the finger -- identify the increasing money-growth that produced the M1 bump. And the upper half of the downtrend after 1993 helped to fill out the bump. After 1995 when the zigzag line drops below zero, the bump curves downward.

So we have a large increase in the quantity of M1 money, from 1989-1995, followed immediately by ten years of good economic performance. But that's not all we have. As the "golden age" link (above) shows, we have a significant drop in debt-per-dollar between 1990 and 1993.

A significant drop in debt-per-dollar at the same time that the number of dollars was rising to create the bump. You could say that the growing quantity of money was the cause in the DPD drop. I say that was part of it, but only part of it. Debt also fell during those years, or grew unusually slowly.

In 1990 and By 1991 the tax code changed. The personal tax deduction for interest expense was eliminated. As a result, people cut back on credit use. That, combined with accelerating M1 growth, created the wiggle in the DPD.

So we have a decline in credit-use, and an increase in the quantity of money. And after 3 or 4 years of that, we get a "golden" decade. Coincidence? Not in my book.

To me, it's Arthurian economics: Reduce the reliance on credit, increase the quantity of money, and accelerate the repayment of debt. In my book the events noted above, leading to a golden decade, are evidence that Arthurian policies work.

Oh -- and look at the effect on the federal deficit:

The deficit maxed out in 1992, then got progressively smaller until we got that first surplus in 1998. And the surpluses increased in size for two years after that, peaking in 2000. That is eight years of continuous improvement in the budget picture.

Clinton? Gingrich? I don't think so. I think the tax-code change of 1990-91 combined with the M1 bump of 1989-95 did the trick. It gave us a golden decade. And it balanced the budget.

It's a picture of weekly values of M1, or spending money. Money in circulation. On the right, in the middle of the fat gray bar, you can see Bernanke's trillions.

What I thought was interesting about this graph was the big bump there in the middle, rising until about 1995, then falling. A big bump in the quantity of money. The bump grabbed my attention because of its timing: 1993-4-5. There was a mini-golden age in the U.S. economy from 1995 to 2004. The good years began in 1995, just as the M1 bump was peaking.

Look at the bump from a different perspective. This graph shows annual change values for the M1 numbers:

M1 money growth zig-zags all over the chart. But the low point around 1989 and the high point around 1993 -- there, where it looks like it's giving you the finger -- identify the increasing money-growth that produced the M1 bump. And the upper half of the downtrend after 1993 helped to fill out the bump. After 1995 when the zigzag line drops below zero, the bump curves downward.

So we have a large increase in the quantity of M1 money, from 1989-1995, followed immediately by ten years of good economic performance. But that's not all we have. As the "golden age" link (above) shows, we have a significant drop in debt-per-dollar between 1990 and 1993.